BANKER | share

Streamlined Operations via Automated Processes and Team Collaboration.

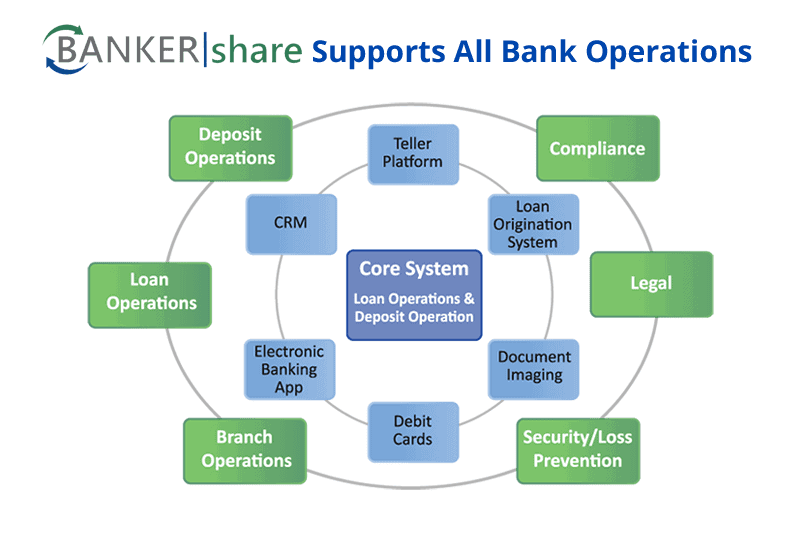

Banking services rely on communications and procedures. When these break down, productivity and profitability stall. Abel Solutions’ BANKER|share platform empowers financial institutions to achieve operational excellence through improved team collaboration and automation of information workflows. The result is increased profits from reduced operational costs.

Banking is Evolving. How Will Your Branches Compete?

Customer expectations are off the charts, and regulatory compliance issues from Dodd Frank to GDPR strain resources and erode profits. For banks of all sizes, process management and information sharing can be overwhelming.

To help banks overcome these challenges, Abel Solutions developed the BANKER|share platform. Our consultants worked closely with banks to automate hundreds of manual operational processes—from loan servicing to compliance. Their effort provided unique insights that we used to create BANKER|share.

To deliver efficiencies in all aspects of your operations and ensure accurate information communication, BANKER|share resides on the Microsoft Office 365 platform and leverages Microsoft SharePoint Online for document management and team collaboration. Additionally, the platform uses Nintex Workflows to automate business processes and Nintex Forms for data entry.

The result is a business process automation and collaboration solution that streamlines operations and drives down operational costs.

How BANKERlshare Promotes Efficiency Across Your Financial Organization:

- Addresses and improves compliance shortfalls that are revealed during branch or bank audits.

- Maximizes profitability by reducing operational expenses.

- Enhances communications across the entire bank.

- Complements existing core products and third-party applications.

- Fills operational and software gaps with “READY TO GO” solutions.

- Utilizes a scalable platform that adjusts to your bank’s current and future growth trajectories.

Take Charge of Your Operational Challenges

Navigating compliance regulations is one of the banking industry’s greatest challenges, with the burden falling especially heavily on smaller community banks. BANKER|share offers numerous workflow and process accelerators that specifically facilitate compliance, whether driven by an audit or an internal review. Below are a few examples:

Track Check-Fraud Status… Start to Finish

Track incidents of check-fraud from initial teller/CSR entering until Loss Prevention closes the case. Attach affidavits, note receipt or denial of funds, and allow approval from branch managers to keep accounts open as requested by customers.

Currency Transaction Reporting (CTR) Review Process

Ensure that yearly reviews are completed with your exempted customers by automating the review schedule for these customers. Track all documentation and research required to address any future audit concerns.

Customer Complaint Tracking

Enable your entire bank staff to input customer complaints so you can assign and track the turnaround time to resolve and close them out. Built-in follow-up reminders will ensure complaints are addressed in a timely manner in full compliance with federal regulations. Quickly, and with minimal effort, prepare board reporting similar to the Consumer Financial Protection Bureau.

Automate Currency Transaction Reporting

Track CTRs between the branch and the Compliance department from beginning to end, including tracking any Compliance requests for additional information from the teller or CSR. At any point in the process, Compliance will have real-time status visibility of every CTR submitted.

Want to learn more about streamlining operations and compliance processes?

Engage us to explore how BANKER|share can benefit your bank.